Among multiple features, Sage 50 includes feature to assist businesses file their annual taxes. You can easily e-file the 1099 and 1096 forms in Sage 50. Like every new year, you have to file the 1099/1096 forms in Sage 50. In this blog post, we will delve into the process for printing the new 1099-NEC in Sage 50 software.

Insights into 1099/1096 Form

You need to comprehend what a 1099 vendor is before you can comprehend what a 1099/1096 form is. Simply put, it is a business or person that does services for you but is not one of your workers. Due to the fact that if you pay these suppliers more than $600 in a fiscal year, you must also give them an IRS Form 1099, they have earned the term. Even if they get less than $600, you should still give them Form 1099 to keep your financial records in order. Make sure you have all the necessary information regarding 1099 suppliers before you actually pay them, so you can properly file 1099 forms for the upcoming tax season.

What is Reported on a Form 1099-NEC?

Payments of all kinds are included in Form 1099MISC.

Most often used are the boxes listed below:

- Box 1: Reporting payments made for equipment, real estate, and machinery rental is done.

- Box 2: should be used to list all royalties due, including any that have already been paid to franchisors.

- Box 3: If the necessary service was not given, please indicate any other income, including any rewards. contains the earnings owed to the deceased workers, which were subsequently paid to the beneficiaries.

Suggested Reading: Reconcile Vat Return in Sage 50

Why Should We Printing the New 1099-NEC in Sage 50?

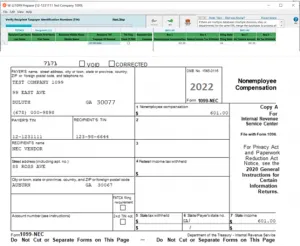

Compensation made to a non-employee is reported using the 1099-NEC form. The reporting of payments made to non-employees will no longer be included in Form 1099-MISC as of 2020, according to the IRS, which also revamped the form. The 1099-NEC has undergone more revisions for 2021.

Different Methods to Printing the New 1099-NEC in Sage 50

The below are the two different methods to printing the new 1099-NEC in Sage 50:

Method 1: For Payroll Subscribers- 4-Part Blank Perforated form or eFile

Note: The 1099 and 1096 forms will no longer be accessible for printing from the Forms menu in Sage 50 as of the 2023.0 release. However, everyone who has a working plan will be able to use Aatrix to print 1099/1096 paperwork. An Aatrix eFile subscription or manual filing with the IRS are required for efiling. Customers using Sage 50 Documents can still print 1099/1096 forms if they are using release 2022 or earlier.

On December 16, 2020, the 1099-NEC Form was made available to all clients with payroll subscriptions via an Aatrix forms update. Navigate to the Reports & Forms >>> Forms >>> Tax Forms, then double-click Payroll Tax Forms to see the most recent tax forms. This will load the most recent forms for you and automatically install any Aatrix tax forms that are lacking.

You must be using at least the 2021.1.1 (ideally 2022.1) release and have the most recent tax update loaded in order for the data to immediately appear on the 1099-NEC form.

Suggested Reading: Install Sage 50 2020 Payroll Tax Tables Update

Steps to Print e-file the 1099-NEC/1096 Forms using Aatrix Forms:

- Go to the Reports & Forms >>> Forms >>> Tax Forms and double-click Payroll Tax Forms at the bottom in order to print or electronically file the 1099-NEC/1096 forms using Aatrix Forms

- From the list of Available Forms, choose the desired 1099 form (1096 forms are also generated as part of the 1099 filing)

- Pick the appropriate filing year

- After that, select the Ok button

- Complete the form by following the instructions and entering any necessary data.

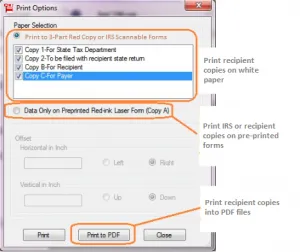

Method 2: For all Customers – Print to 3-Part Red Copy or IRS Scannable Forms

Important Note: The 1099 and 1096 forms won’t be accessible for printing from the Forms menu in Sage 50 after the release of 2023.0. However, through Aatrix, any clients with an active plan will be able to produce 1099/1096 forms. The IRS must receive a manual filing or an electronic filing through Aatrix. Customers running releases 2022 and earlier can still print 1099/1096 forms using the Sage 50 Forms menu.

You can print the 1099 and 1096 forms through Sage rather than Aatrix if you do not have a payroll tax subscription.

To Print the 1099 and 1096 Forms using the Sage 50

- Select Forms, Tax Forms under Reports & Forms

- Choose the 1099-NEC or 1096 form that you want

- Choose the reporting year

- Vendors can be filtered by ID, active/inactive status, or payment method

- To obtain a preview of the printers, click on the “Refresh List” option

- The 1099 forms can be printed by selecting Print/E-mail or by selecting Print Preview to see a screen preview of them.

Suggested Reading: Sage 50 Payroll Employee Licence

Conclusion

The below are the discussed possible methods to Printing the new 1099-NEC in Sage 50. In case, you face any difficulties or stuck in between the steps, you can reach out the Team of Experts using Sage Helpdesk Team. Moreover, you can use our Live Chat option to connect with Professionals.

FAQs

Q. How to Access the 1099-NEC Filing Forms for use with Sage Checks & Forms?

Ans. The below steps help you to access the form files with Sage Checks & Forms:

- Initially, save the .FRM files

- Find the data path for Sage 50

- Find the Forms folder inside the Sage 50 data path

- The .FRM files you obtained should be copied from your desktop and pasted into the Forms folder

- The forms will now be visible in the Tax Forms area of your Sage 50 Forms when you open Sage 50 and your company

- The forms’ names are as follows:

- Form 1096 2021 Preprinted

- Form 1099-MISC 2021 Preprinted

- Form 1099-NEC 2021 RED

Q. How Do We Align 1099/1096 Form in Sage 50?

Ans. It is advised to print an alignment sheet before printing to ensure the data will line properly on the form due to variations in the specific printer being used. The steps listed below will let you print an alignment page in Sage 50.

- Select Forms, Tax Forms from the Reports & Forms menu while your Sage 50 company is open and check

- Select the form you want to align (1096 IRS 2020, 1099-MISC IRS 2020, or 1099-NEC IRS 2020) in the Select a Report or Form window, then click the Customize button

- Make sure your preprinted 1099 form is loaded into your printer before selecting Print from the top toolbar in the form designer window

- You will be asked “Did the form align properly?” after printing the placeholder data, and you can select “Yes” or “No”

- If you choose “No”, you will be given the opportunity to position the form field up, down, left, or right and print a different sample

- The alignment of the form will stay as is if you choose “Yes”.

Q. How Can I Print or e-file the State Quarterly Forms in Sage 50?

Ans. The below are the steps to print or e-file the state quarterly forms in Sage 50:

- Choose Forms from the Reports and Forms menu

- Tax Forms can be accessed by clicking on it

- The Select a Report or Form window will appear

- Double-click Payroll Tax Forms next

- Select the State form type by clicking on it

- Choose your state

- Indicate the state that you want to print or e-file for

- Select the filing period area by clicking it

- Give the year and quarter

Note: Please be aware that you will need to choose your preferred year and quarter once again if you click on a different form.

- To continue, click on the Ok button

- Observe the instructions as they are shown on the screen.