In most cases, when a client doesn’t pay an invoice because of a dispute or liquidation, the invoice has to be written off. Writing off the customer’s invoice is made easier by posting the credit note to the nominal ledger account for the bad debt. The loss for the current fiscal year is reduced by the bad debt. If you use the standard VAT Scheme, you might be eligible for Write off a Bad Debt in Sage 50.

When the business hasn’t received any payments, users frequently obtain each Sage 50 invoice that is a bad debt and look up How to Dispute Sage 50 Invoices. Moreover, we’ll discuss the step by step instructions to write off a customer bad debt in Sage 50 in this particular article.

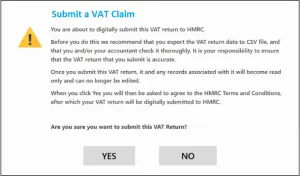

Prerequisites Before You May Submit a VAT Claim

- While writing the credit note, you have the option to eliminate the debt in the general ledger and transfer it to a specific bad debt account.

- The VAT on the shipments was already reported to HMRC, and it was paid there.

- Less than four years and six months have passed since the obligation became due, although it has been more than six months.

Need Expert Help: Are you getting Write Off a Customer Bad Debt in Sage 50 and don’t know how to solve it? In that case, you must get immediate help from our SAGE 50 LIVE CHAT EXPERTS by dialing the ReConcileBooks helpline number at any time.

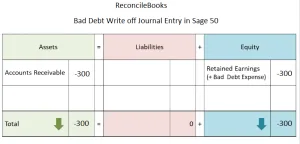

There are Two Methods to Write Off a Customer Bad Debt in Sage 50

- Direct Method: As soon as a bad debt is recognised, a posting is made to the expense account designated for bad debt expenses for each invoice that is a bad debt.

- Allowance Method: At the end of each fiscal year or on a regular basis, a portion of your accounts receivables are written off. Depending on the percentage of bad debt you estimate your business will accrue annually, you can determine how much gets written off. Typically, a General Journal entry would be made affecting the “Allowance for Doubtful Accounts” and “Bad Debt Expense” accounts receivable (used as a contra-asset) (an expense account). Then, as the bad debt is recognised, each invoice is written off to Allowance for Doubtful Accounts.

Step by Step Instructions to Write off a Customer Bad Debt in Sage 50

Simply perform the below suggested steps to easily write off a customer bad debt in Sage 50:-

Step 1: Write off the Bad Debt

- On the navigation pane of the Home window, select the “Customers & Sales” option

- Choose Sales Invoices >>> Invoice, and then select “Create Invoice”

- The customer whose debt won’t be paid should be chosen from the list in the Customer box

- Enter the original invoice number, followed by the letters “WRTOFF”, in the Invoice Number field

- Put a negative number in the Amount field to represent the amount owing

- A list of accounts will appear when you click the list button in the Account column

- Ensure that the All Accounts button is chosen

- Pick the Bad Debts account by selecting it

- Choose the Allowance for Doubtful Accounts option from the list if your accountant has set it up to handle bad debts

- Enter the tax code from the original, unpaid invoice in the Tax column

- Choose Display Sales Transaction Detail from the Report option to confirm the transaction

- In the end, click on the “Process” button once you are satisfied with the entries.

Suggested Reading: Reconcile VAT Return in Sage 50

Step 2: To Offset Both Invoices in the Recipients Window

- Click Clients & Sales in the Home window, then click Receipts in the navigation pane

- Choose the same client from the instructions above from the list in the Received From box

- The table automatically displays both the original invoice and the one made in the first set of instructions

- To see the totals for both invoices, click the Amount Received column

- Choose Show Receipt Transaction Detail from the Report option to confirm the transaction There should be no balances on the debit or credit side

- Click Process once you are satisfied with the entries.

Suggested Reading: Making Sage Digital Tax for Vat

Note: If you want to put the taxes you owe in a different account, talk to your accountant first.

Conclusion

Hopefully, this article covered how to Write off a Customer Bad Debt in Sage 50. You can easily contact the team of specialists to receive better assistance with less delay if you want to learn more about accounting software and the best way to resolve Sage 50 problems or any other functional issues. The team will be committed to answering all of your questions all round the clock. If you have any specific query, also get in touch with the experts of live chat 24*7 helpdesk.

A Frequently Asked Questions

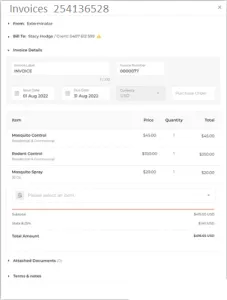

Q. How to Write-off the Sales Invoice-Standard VAT in Sage 50?

Ans. The below step help to write-off the sales invoice-standard VAT in Sage 50:-

- Search for the Sales button

- Next, click on the desired invoice

- Check the form’s date range and any fields with an invoice date if you were unable to locate the invoice

- Choose the Outstanding or All tabs

- Choose Generate Credit Note after clicking the More option

- After that, fill in the information listed below:

- Customer

- Credit date

- Reference

- Address

- Description

- Price/rate

- Ledger Account

- VAT Rate

- Price/Rate

- Verify that the VAT rate is the same as it was on the original invoice. If not, you won’t be able to apply the credit note to the bill. These fields must be filled up.

- Press the Save Credit Note button.

Q. Is it Possible to Write-off an Invoice that is Not Paid at all as a Bad Debt?

Ans. Yes, you can write off unpaid and partially paid bills in Accounts Receivable.

Q. How to Verify the Bad Debt Nominal Ledger Account in Sage 50

Ans. You should check to see if the bad debts nominal ledger account is visible for sales prior to making a credit note with it.

The steps are as follows:-

- Go to the Settings tab and then click on the More button

- Then click Business Settings in the Finance settings section

- Make sure to click on the Chart of Accounts icon

- Locate the name box or code, then enter 8100

- Choose the Bad Debts ledger account in the nominal ledger

- Choose the Sales-Invoice/Credit or Customer defaults checkbox by selecting the Visibility option

- At last, hit the Save button.