Taxes are not easy to deal with, and no one should be able to say otherwise. But, one cannot ignore the fact that taxes are one of the most important aspects of a successful business. One of the most important aspects of taxes is that each tax is unique. Hence, it is all the more important for you to be able to better understand them accordingly. But one cannot deny the fact that the taxes can drive you crazy and you are not alone in this. Taxes are complicated hence a good deal of assistance and guidance is the call of the day. For this, we present to you this Self Employed Taxes For Dummies A Foolproof Compliance Guide.

The 1099 Independent Contractor

According to the IRS, self-employed contractors are classified as ‘Independent Contractors’. This comprises various business set-ups that are more like the ‘one-man show’ as opposed to a full-fledged enterprise. Freelancers, Writers or Graphic Designers are a few examples of independent contractors. Also the same applied to the individuals who work for the Shared economy. Other examples to illustrate this includes a listing of the vehicles on Turo, hosted on Airbnb, utilizing Upwork for freelance work or driving for Uber. The independent contractor can set up their fees, time and schedule for their work. Hence, automatically, you as an independent contractor also need to calculate and remit your taxes. This is because you do not have to deal with an employer who is withholding your taxes on your behalf. For this, many self-employed contractors get hold of the 1099 forms.

The 1099 Form: All About It

This form is essential for reporting income. There are various forms under the 1099 type; the 1099 K and 1099 MISC are the common ones. These forms are used by businesses to report income in case of the independent contractors.

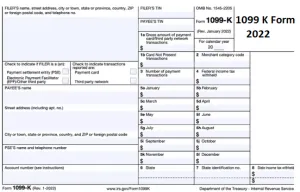

The 1099 K Form

This is a 1099 form type that can be received from a third-party site like Airbnb, Turbo, Uber or Upwork. This is because these companies are responsible to facilitate the payments for your services. However, it is important to bear in mind that you need to reach a minimum of 200 transactions to be able to issue 1099 forms and also own over 20K in revenue. Additionally, the fee charged by the third party is subtracted from the total earnings.

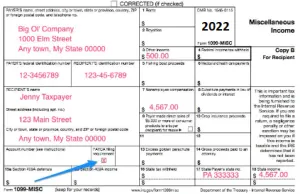

The 1099 MISC

Form 1099 MISC is issued both by individuals and businesses. This is issued to the contractors by the businesses when they are paid more than $600 over the year.

For instance: in case you work as a freelancer, and earn $1200 for a year from a particular client, hence you are entitled to receive the 1099 MISC form. The same is applicable in the case of business as well, as in case you pay the contractor more than $600 then you need to issue the 1099 MISC form.

Likewise, it is important to ensure that you correctly report your income, in case you need to issue this for type. A copy of the same is also issued by the IRS, and your income will be cross-checked by the agency. So, you see, you must remain true to what you are reporting.

The 1099 Contractors and the Self Employed Taxes For Dummies

There are a few tax-related responsibilities for Self-employed taxes for dummies earners or working as independent contractors. This is also important because In case you fail to do so, you will be faced with severe penalties and payment of interest to the IRS.

The Estimated Taxes

The estimated taxes need to be paid on time by the self-employed earners. This is because you don’t have an owner, hence the taxes are not withheld from your income throughout the year. The estimated tax payment is vital, as the IRS does not wish to wait and collect the same from you.

So, how do you know if you owe any estimated taxes? Are you expected to owe more than $1000 in taxes? If it is a ‘yes’ hence you need to pay estimated tax payments. It is expected from you to pay the estimated taxes every quarterly period, according to the IRS.

If you have any specific query, also get in touch with the experts of live chat.

When are the Quarterly Taxes Due?

The quarterly taxes, as the term suggests, needs to be paid each quarter of the year. This is also known as the Quarterly taxes.

The important payment dates are:

- April 15

- June 15

- September 15

- January 15

In case the due date falls on a holiday or a weekend, the payment needs to be done the next business day.

The Quarterly Taxes: How To Pay Them

This is tricky for most, as one wonders how you pay the taxes on an income you are yet to earn. One of the most fool-proof methods is to pay the same amount as taxes as you paid the previous year and divide it by 4. For instance, if you had paid $1200 in taxes the previous year, you need to divide this by 4, which equals $300, which is the final amount you need to pay as Quarterly taxes.

Online is one of the simplest platforms to pay your taxes and also the easiest. This can be done with a few clicks on the IRS website where you need to create a simple account and pay conveniently.

Filing Off the Taxes: For the Self-Employed

The filing of the self employed taxes is not the same as for the W2 employees. It is important to pay close attention to the tax deductions and all the sources of income to be able to do so smoothly. There is a certain ‘Schedule C’ that you need to fill out in the form when preparing the Self-employed taxes for dummies.

The IRS Schedule C

Schedule C is used to report the loss or income for the business you operate. This is where you need to fill out the income earned by you and the deductible expenses. To fill out the form you need to get together all the accurate details about your business. It is required to rightfully submit both the name and nature of your business.

Likewise, you also need to submit the tax ID number or the Social security number in case you do not have a tax ID number. To complete Schedule C, one needs to calculate the business income. This includes the income from the services, receipts, allowances or returns, tax credits and refunds. Next, you need to enlist the business expenses, which are nothing but deductible expenses that need to be leveraged against the taxable income to lower your tax bills. Finally. It is the Net Income that you are left with and that needs to be reported on your 1040.

The Self-Employed Tax Deductions

Tax deductions are a vital aspect of self-employed taxes and can greatly lower tax liability. Here, it is important to know which tax deductions apply to your business.

Learn more about our: Payroll Tax Calculation Errors

Some of the basic tax deductions in the case of self-employment include:

The Cell Phones and the Internet

Most businesses today require steady cell phones and internet services. Here the IRS allows the individual to deduct the business part of the cell phone and Internet.

The Business Insurance

Various business-related insurance premiums like commercial vehicle insurance and liability insurance are categorized as Deductible insurance. Here, only the important insurance policies are included. Hence, you need to consider only those insurances that can protect your businesses.

The Health Insurance Premiums

The cost of health insurance premiums is deducted in the case of Self-employed taxes for dummies. This also includes dental and qualified long-term care premiums. Also one can easily write off the premiums for their spouses and other qualified dependents.

The Meals

The meals that are business related are also tax deductibles. This refers to the situation where you meet your clients for lunch or coffee or a meal while on the road for your business. In such a case the cost of the meal is deductible for up to 50%. However, one has been bearing in mind that the meal cannot be too lavish nor does it includes the meal you have at your work desk alone.

Home Office Deductions

This feature comprises the aspect where you can deduct $5 per square foot for up to 300 square feet for separate home office space. Here one has to take note of the fact that the word in question is ‘exclusive or separate home office space’. This implies the fact that the space is used for the sole purpose of business and office. This could also be a simple corner of your kitchen that can be considered as ‘your business space’ if you are using it for the purpose.

Travel

Also, the cost of travelling when on business is qualified for this tax. This is inclusive of vehicle rental expenses, hotel accommodations, airfare, and other travel-related expenses.

The Self-Employed Taxes

In the case of self-employment, you are entitled to Self-employed taxes for dummies. This is applicable for both the employee portion of the social security and employer along with the medicare taxes in the amount of 15.3%. Keep in mind that half of the self-employee taxes are tax deductible because this comes under the employer’s portion of the tax obligations.

The Tax Deduction Worksheet

It is important and advised to be aware of the tax deductions that apply to your business. Here, you need not leave any money on the table. Hence the tax deduction worksheet is a great tool to help you prepare your schedule C.

Read also: Difference Between Form 8938 and FBAR

The Self-Employed Tax: The other Considerations

One has to understand the fact that taxes are a complicated matter. While there are no universal rules for the same, however, you need to be aware of your options. There are various tax strategies for different benefits and the subsequent downside.

Here are some considerations one needs to take care of:

Leveraging the Deduction With Income

Based on the income limits, IRS has imposed a specific deduction amount taken by you. Also, one can face fines and penalties if one fails to pay the same on time. The rule is simple; people with higher income will receive smaller write-offs for such deductions. For instance, some taxpayers deduct medical expenses that are more than 7.5% of their income.

Estimated Taxes

Self-employed taxes for dummies workers must pay the estimated taxes on their income. Failing to do so can have your face paying fines and penalties. Essentially, the government wants the money that belongs to it, so it is always safe to get your records right.

Estimated Taxes For Wage Earners

Most taxpayers avoid paying estimated taxes as it can get complicated. However, W2 wage earners can entirely avoid tax payments if they are gainfully employed. Regular wage earners can also increase their income withholdings to cover their estimated file tax return. By this, wage earners can easily clever their estimated tax payments with the help of these additional withholdings.

Joint Filing with a W2 Earner

It is advised for married couples to take close consideration for the best filing options. The couples can either file together or separately. However, joint filing greatly decreases the year-end tax burden; while it might not be the best option always.

CONCLUSION

Taxes are confusing, complex and not so desirable by most people. But they are essential, hence a better understanding of the same is the call of the day. However, in case you have doubts about the same, be free to get in touch live chat with our team of experts and we will help you out reconcilebooks. To get the best assistance regarding the Self-Employed Taxes for Dummies, you can simply dial +1-347-967-4079 to contact our tax Specialists Team.

Frequently Asked Questions

How Does one Calculate the Self-Employment Taxes?

One can easily calculate the self-employment taxes based on the rates in the force on the net earnings arising fromSelf-Employed Taxes for Dummies that are acquired after deducting the business expenses from your business revenues.

Is it Possible to Avoid Paying Taxes as a Self-Employed Individual?

Yes, one can easily reduce the tax liability by taking maximum advantage of the exemptions and deductions offered in the income tax act.

What is the Self-Employment Tax Rate for the Year 2022-23?

Currently the self-employment tax rate is 15.3% of the net income. This is calculated as the total of the 12.4% Social Security and 2.9% Medicare Tax in net income. However, self-employment tax is not the same as the income tax:

The first $147000 of the earnings is subjected to the Social security portion, as in 2022. However, for the year 2023, it can rise to $160200.

In case the net earnings from self-employment exceed $200000, an additional 0.9% Medicare tax is also applicable. This is applicable if you are a single filer or $250000 in the case for joint filing.