Auto-Enrolment Employer Payroll Item in QuickBooks

When it comes to the new Tax Year, you are presently ready to deal with the QuickBooks Payroll Auto Enrolment in QuickBooks Online. The payroll will provide you with an additional tab where you can set-up and deal with the workplace pensions. QuickBooks Payroll Auto Enrolment permits a little percent of employee wages to be paid inside a pension scheme. While your employees achieve the age of pension, these sums will pay them an additional salary, over their State Pension.

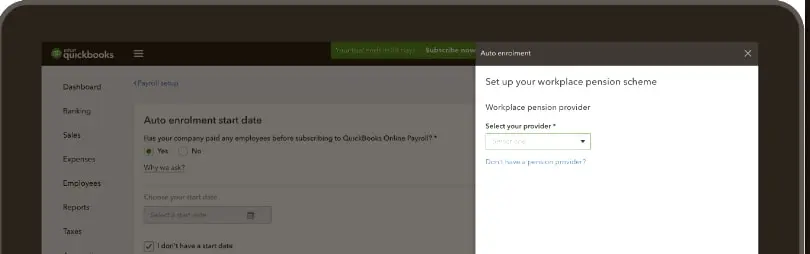

How to Setup Intuit QuickBooks Payroll Auto Enrolment

Set Up QuickBooks Payroll Auto Enrolment

- Visit the auto-enrolment setup window.

You may set up the auto-enrolment amid payroll setup or else at the next time. In case you have qualified representatives amid a payroll run, you will be provoked to enter the details of your pension scheme.

- Amid the Setup, visit the Employees section, after that choose Auto-enrolment, or in case you have just begun setting up, visit the Employees section> then select Auto Enrolment. Now you have to finish the step by step procedure.

- Amid a payroll run, then you will be provoked to the auto-enroll. Choose Enter pension details option.

- Submit your staging date or else duty start date.

- Submit your supplier or provider details:

- Choose your supplier/provider. In case you do not have a supplier/provider, then select a pension supplier/provider. Intuit likewise gives a rundown of several popular pension supplier or providers who will be fin your requirements. In case you select another pension supplier/provider, then choose other option and then submit their information.

- Submit the supplier or Provider reference.

For advance tax calculation, return, rebate & refunds there are various tool available just dial QuickBooks Payroll Support Number and know how to save more on the payroll tax. Also find out how many QuickBooks Tax Form can be file online.

- Select even if you will utilize workers income edge for the auto-enrolment.

Choose this alternative just in case you have picked this option while you were setting up the pension scheme with the pension supplier or provider. Representative income edge will utilize characterized limit in order to compute the pension contributions for you as well as your worker.

What’s the Income or Earning Threshold?

Auto-enrolment edge or thresholds for the year 2018-2019

| Qualifying income/earnings | Annual |

| Lower level | £6,032 |

| Trigger for auto-enrolment | £10,000 |

| Upper level | £46,350 |

Select the Kind of taxation technique.

Choose one of the choices. In case you don’t know which strategy to pick, then work with your pension supplier/provider. You may likewise need to confirm with your pension supplier for which tax technique they utilize.

Submit the default rates for contribution.

Rates which you enter amid the setting up apply to everybody in the organization. Note that your boss and representative contribution rates should as of now be characterized with your pension supplier. In case you need to modify the rate of contribution for a particular worker, you may do as such while you run the payroll.

Keep in mind that you are needed to contribute a similar sum, in view of regular pay, in the representative’s workplace pension when the worker is on statutory leave.

Get Help Automatic Enrollment Payroll QB Issues, Errors

In the tax timing due to a large number of customer queries QuickBooks Support Phone Number works all the day.In case you are facing any trouble while working on QuickBooks Payroll Auto Enrollment, you can reach our ReConcileBooks via QuickBooks Live Chat Support team. We are the most trusted and renowned third party QuickBooks service team which provides the best resolution of your problem instantly. Call our 24*7 toll free phone number at +1347-967-4079 and get instant resolutions.