Organizations who utilize agricultural or rural laborers should report the Social Security as well as Medicare charges and government income tax charges withheld on the QuickBooks Payroll 943 form, Annual Tax Return of Organizations for Agricultural Workers. On the off chance that the liability of the tax is kept semiweekly, at the point QuickBooks Payroll 943 filer is needed in order to list the amount of liability on QuickBooks Payroll Form 943-A.

QuickBooks incorporates the Excel sheet which consists of worksheets intended to gather and arrange data and information required in the QuickBooks Payroll 943 Form. The QuickBooks Payroll 943 worksheet demonstrates sums for assessable wages and the amount of tax for government income tax withholding, Medicare, and Social Security. It likewise demonstrates the aggregate for advanced gained income. You can outline the 943 information into the Excel and utilize the data to file the QuickBooks Payroll Form 943 with IRS. More detail of available about Taxes and Forms (USA) QuickBooks on world leader payroll software help provider.

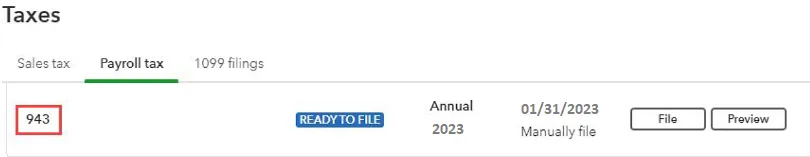

QuickBooks Payroll 943 Form Option

Clients who have the Standard or either Enhanced Payroll membership can prepare as well as file the Payroll 943 Form into the QuickBooks.

If you have any specific query, also get in touch with the experts of live chat.You should file QuickBooks Payroll 943 Form – A: The Federal Tax Liability Annual Record and file it with QuickBooks Payroll 943 Form in the event that you are a semiweekly investor or in case your liability of the tax on any of the day amid the timetable year is $100,000 or above.

QuickBooks Payroll Form 943-A rundowns the liability of the tax accumulated on every day of the logbook year. The aggregate liability of the tax should match the Line 11 on the QuickBooks Payroll Form 943.

User can get in touch with QuickBooks payroll in case they need help & information about any payroll tax forms like W2, W3, 940, 941, 1099, 945 etc.

Read more information: QuickBooks Payroll Quarterly ReportsHow To Create QuickBooks Payroll 943

Create the Payroll 943 Form into the QuickBooks Desktop.

In Order to Create the QuickBooks Payroll Form 943:-

Important: In case the form isn’t accessible while you open the chosen Payroll Form screen, at the point, you have to update the payroll tax tables.

- Select Employees option >> then click on the Payroll Tax Forms & W-2s button > after that click on the Process Payroll Forms option.

Choose Annual Form 943-943A – Organization’s Annual Federal or government Tax Return for the Agricultural workers. Click on the File Form button. Click and alter the year into the option ‘Select Filing Period section, in case required, and then click on the OK button.

- Ensure the details on every interview page, and then click on the Next button until you see Save and Close or either Save as a PDF file.

Important: Prior to saving the document, it is suggested that you to the print a duplicate copy of the form.Important: Now, you not able to utilize E-File or either E-Pay in order to process your Form 943.E-File 943 Form QuickBooks

- E-filing the QB Payroll 943 form is completely secure as well as accurate. While you e-file, at the point the framework sends an affirmation that the IRS will get the return within 24 hours.

Electronically filing the returns includes utilizing a 3rd party who can transmit the returns for a little charge. Investigate your options mentioned below.

Read more: QuickBooks Payroll Not Calculating TaxesOption 1

Contact to an Authorized or certified IRS e-file supplier or Provider in order to sign, prepare and e-file your return effectively.

Option 2

Purchase the IRS-approved application accessible via an Authorized and certified IRS Online Filing supplier or Provider. Utilize the program in order to send the return to a suitable and approved provider who is proficient in e-files the 94x returns easily. There are the 3 signature alternatives for you. Several suppliers or providers don’t provide every signature options. Select a provider who provides the signature option as you require.

Online Signature PIN

Finish the Online 94x PIN Registration procedure which is available in the program to wind up an approved data of your organization’s 94x returns. Utilize your 10-digit PIN in order to sign on these tax returns. It might take up to 45 days in order to get your PIN.

Conclusion

Although above information will guide the user to know all about 943 form via QuickBooks, but in case user need help they can reach at us via QuickBooks expert team. In case you need more information or you are facing trouble to use the QuickBooks Payroll 943 Form, call our ReConcileBooks 24*7 toll free QuickBooks helpdesk.

Frequently Asked Questions (FAQs)

Form 943 is the employer’s annual federal tax return for agricultural workers. Employers use this form in the agriculture industry to report Medicare, Social Security and income tax withheld from their employees. Form 941 is the employer’s annual tax return.

The number 943, on its own, does not have a specific purpose. It is simply a numerical value. The purpose of a number depends on the context in which it is used. Numbers can represent various things, such as quantities, measurements, identifiers, or positions, depending on the domain or situation in which they are employed. Without additional information about the specific context or application, it is not possible to determine the purpose of the number 943.

Employers who pay agricultural wages and withhold federal income tax, Social Security tax, or Medicare tax from their employees’ wages need to file Form 943.

Yes, it is possible to file Form 943 electronically through the IRS’s e-file system. QuickBooks payroll provides the option to e-file the form directly from the software.