QuickBooks software offers an assortment of payroll reports that give an abundance of knowledge about your organization’s representatives as well as payroll expenses. These payroll reports can give information about individual representatives or you can gather information covering all workers. All reports additionally can be traded to a spreadsheet effectively, permitting you relatively boundless alternatives for how to utilize the data. QuickBooks Gross Payroll Report is very helpful.

How To Generate QuickBooks Gross Payroll Report

This report gives itemized information about how taxes are calculated on representative paychecks as well as in year-to-date exchanges or transactions in the QB Desktop. You can utilize these reports as a research tool.

Ensure you have a dynamic and active payroll membership and the most recent release of QuickBooks Desktop application as well as Tax Table updates.

About Employee and Payroll Reports

To make a payroll information audit or review report, find the steps mentioned below:-

- Click on the Reports menu dialogue box

- Now, click on the Employees & Payroll option

- Open the Payroll Detail Review.

In case you want to customize or change the payroll detail review report, follow the steps below:-

QuickBooks Desktop application will show the year to date payroll information and data. You can modify or customize the report by simply altering the date range as well as using filters in order to add/remove the columns on the report.

Suggested Reading: QuickBooks Desktop Google Sheets Integration

To Customize Gross Payroll Report In QuickBooks

- Click on the Customize Report button.

- Now, click on Display option and then open the date range from the given drop down menu list or you can fill into from and to dates.

- In order to run the report particular to a paycheck date, submit the paycheck date as given in your from and to dates.

- Click on Filters button.

- Select the particular items given in the Filter list that you need to show.

Examples:-

- To choose particular workers from the list of all names:

- Click on the Name option in the Filter list.

- Click on the down arrow button which is next to the All names option and then choose Multiple names.

- In the Select Name screen, you have to click on the name of Employees or workers whichever you want.

- Click on the OK button in order to save your settings.

Need Expert help:- Are you getting QuickBooks Gross Payroll Report and don't know how to solve it? In that case, you must get immediate help from our QuickBooks live chat experts by dialing the ReConcileBooks helpline number at any time.To show payroll transactions for example YTD (year to date) Customization/Adjustment or Liability Adjustment:-

- Click on the Transaction Type button given in the Filter list.

- Select the type of transaction from the given drop down option.

- Click on the OK button in order to save the settings.

- In case you need help, click on the Tell me more…dialogue box that it ears on the lower right side of Customize Report screen.

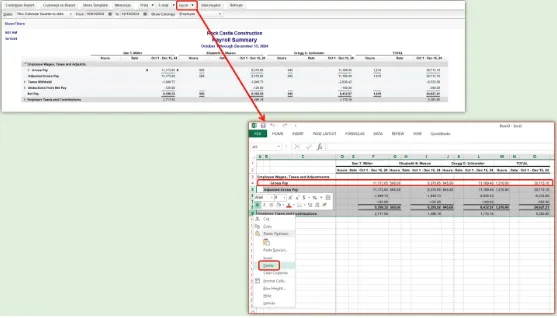

- If you want to export the payroll detail/information review report into the Excel spreadsheet:

- Into this report, you have to click on the drop-down arrow of Excel.

- Choose to Create New Worksheet either Update the Existing Worksheet.

Suggested Reding: QuickBooks Desktop Import Bank Transactions

To utilize payroll detail review/audit report in order to research wage as well as an error in tax calculation:-

- Confirm in case the employee had achieved the limit of wage base. QuickBooks Desktop application quits calculating the taxes once the workers had exceeded the wage base limit.

- In case of flat rate taxes (Social Security, FUTA, Medicare) affirm the amount of tax calculated are in the right way with respect to wage base limit.

Get Help for QB Payroll Reports Problem & Issues

In case you find any difficulty in the QuickBooks payroll report, reach our ReConcileBooks QuickBooks experts. We have a highly skilled and dedicated QuickBooks Intuit Proadvisor Team which is always active to help you.

Frequently Asked Questions (FAQs)

To generate a Gross Payroll Report in QuickBooks, go to the Reports menu, select Employees & Payroll, and then choose the report type that you want. You can customize the report by selecting the date range and other options, and then click on the “Run Report” button to generate it.

Yes, you can customize the QuickBooks Gross Payroll Report to show the information that you need. You can select the date range, choose which columns to include, and filter the report by employee, department, or other criteria.

The QuickBooks Gross Payroll Report can help you monitor your payroll expenses and track your payroll costs over time. You can use the report to identify trends, compare pay periods, and identify discrepancies or errors in your payroll records. This information can help you make informed decisions about your payroll budget and staffing levels.