You can use QuickBooks to keep track of your sales, expenses, and every other accounting factor pertaining to your company. For each account you create, you can build up a variety of particular accounts and items, but there isn’t a specific mechanism to create a deferred revenue item. The “Other Current Liability” account choice and the “Other Charge” items option must be used in order to create a deferred revenue item in QuickBooks. In this blog post, you’ll learn how to setup deferred revenue in QuickBooks.

What is a Deferral in Accounting?

Money collected or paid before a good or service is delivered is referred to as a deferral.

Examples of deferrals are as follows:

- Premiums for insurance

- Services with a subscription (newspapers, magazines, television programming, etc.)

- Renting in advance

- Deposits for goods

- Customer agreements (example: cleaners)

- Sporting event admission tickets

Step by Step Instructions to Setup Deferred Revenue in QuickBooks

Simply perform the step by step instructions in order to successfully setup deferred revenue in QuickBooks:-

Step 1: To start the program, double-click the “QuickBooks” icon on your desktop. The “Charts of Accounts” option can be found by clicking the “Lists” option. For a new account, click the “+” icon

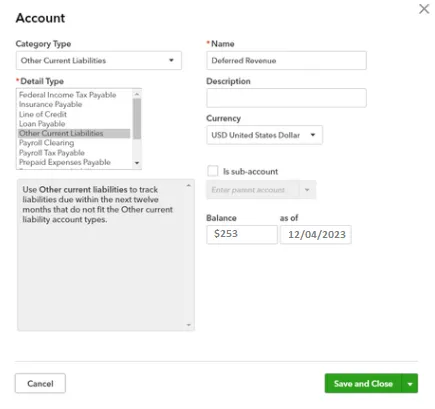

Step 2: Deferred revenue should be typed into the Name field after choosing the “Other Current Liability” option from the Type menu. Complete the remaining fields to create the account.

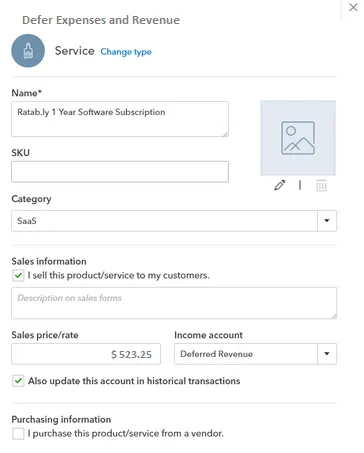

Step 3: Select “Items” from the list of options under “Lists.” The “+” button must be clicked to add a new item.

Step 4: Enter “Customer’s Deposit” in the Name field after choosing the “Other Charge” option from the Type menu. In the “Amount” field, enter the deposit amount. Complete the remaining fields so that the item can be created.

Step 5: Choose “Create Invoice” under the “Customer” heading. From the “Item” menu, choose the other charge item you generated in Step 4. Fill all the necessary fields to produce the invoice.

Step 6: Every time you get a fresh deposit, go back and repeat the first three steps. Create a final invoice for the full cost of the service after the final payment has been received. Subtract the payment items from the total.

To get the best assistance regarding the Setup Deferred Revenue in QuickBooks, you can simply dial +1-347-967-4079 to contact our QuickBooks live chat specialists team.

Why Defer Expenses and Revenue?

To ensure that its financial accounts are correct, a corporation would postpone spending and revenue.

- In other words, a seller accounts for a product’s revenue at the same time that its production costs are spent.

- When a product is consumed, the costs associated with it are taken into account by the buyer.

As an example, consider a seller. This time, let’s examine a magazine subscription that Anderson Autos purchased. National entertainment publication “Film Reel” goes by the name. It concentrates on material associated with upcoming motion pictures.

The whole $602 for the following year’s subscription is paid by Anderson Autos in November. The $602 can no longer be attributed to sales revenue on Film Reel’s income statement, according to the accounting department. The cost of goods sold, or the expenditures associated with manufacture, cannot be included because the magazines haven’t yet been made.

For one subscription, it might not seem like a significant concern to allocate the money to sales revenue, but consider doing it for 100 or 1,000 memberships. The profits would be inflated, and management of the business would not have a clear view of costs vs revenue. On the magazine’s balance sheet, the sum will be listed as a liability instead. A monthly total will be added to the sales revenue on the income statement at the end of the subscription term as each month’s revenue is realized, until the entire subscription amount has been taken into account. expenses of items sold during these same times will represent the real expenses incurred to generate the prepaid problems.

Conclusion

We hope this information helps you to understand How to Setup Deferred Revenue in QuickBooks Desktop, but sometimes you can face several issues while using or performing the steps. If you are not able to understand any point in this post or you are having some issues while performing the process then you can get our ProAdvisor from our QuickBooks Helpdesk Team.

Frequently Asked Questions

Q. Is Deferred Revenue a Credit or a Debit?

Ans. In order for a company’s books to balance, debits and credits are used in the bookkeeping process. Debits result in an increase in asset or expense accounts and a drop in liability, revenue, or equity accounts. Credits work the other way around. Each debit entry must have a corresponding credit entry for the same monetary amount, and vice versa, when documenting a transaction.

Q. What is the Difference Between an Accrual and a Deferral?

Ans. Expenses and revenue are divided into accruals and deferrals, respectively:

Unpaid bills and received payment for expenses that a business must account for are known as accrued expenses. The section “Liabilities” of a company’s balance sheet would be used to record accrued expenses.

A company’s accrued revenue consists of sums that are owing to it but for which no invoices have yet been generated a balance sheet lists them as “Assets”.

Costs that a business has prepaid are referred to as deferred costs. A balance sheet lists them as “Assets”.

Deferred revenue is money that a business has gotten in exchange for goods or services, but hasn’t yet been billed. A balance sheet would classify them as “Liabilities”. The simplest method to differentiate between “Accrued” and “Deferred” is to remember that with each postponed expense, money exchanges hands first. The last transaction involves accrued expenses.