Well, it’s no secret that managing a business doesn’t always involve the most enjoyable activities. It can be very difficult, especially if you don’t have a proper system in place, as landlords are well aware. The wonderful news is that there is software available to help simplify accounting.

If you’ve ever looked for accounting software for professionals, you’ve definitely encountered QuickBooks. This article explores how to setup and use QuickBooks for rental properties accounting as well as if it is appropriate for landlords. In addition, we’ll discuss its advantages and disadvantages in comparison to landlord-focused rental accounting software.

How Can you Use QuickBooks for Rental Properties?

Among the many ways you can use QuickBooks for real estate is to keep track of the revenue and costs related to your portfolios of rental properties.

However, QuickBooks is generally made for small to medium-sized businesses. QuickBooks can be difficult to utilize for rental properties for the same reasons that make spreadsheets inappropriate for rental portfolios. Essentially, you need to manage rental income and expenses separately for each property, ideally unit by unit. In fact, it’s almost necessary to manage each property as a separate company.

This requires utilizing a different spreadsheet for each property when using spreadsheets, which can easily become out of hand. The QuickBooks user interface is also not intended for people who manage multiple different accounts.

In other words, you could be better off using property management software unless you’re an expert or have a lot of expertise with QuickBooks. It allows you to manage individual properties and is intended to make tracking income and expenses as easy as possible because it was specifically created for landlords.

Additionally, good property management software should have features that are specialized to the industry, like online rent collecting, customizable reports, and rental applications.

Setting up QuickBooks for your Rental Property

Follow these instructions to set up your account and begin entering rent payments if you opt to use QuickBooks accounting software for rental property.

Setting up:

- Add the bank account for your company

- Create your customers as tenants

- Create classes for your properties

- Utilizing the categories listed in Schedule E, set up your Chart of Accounts

- Choose your income sources as Products (Rent, Late Fees, Pet Fees)

- Create recurring rent payment invoices.

To Enter Rent Received:

- To start entering your rent receipts, select Receive Payments from the customers’ menu

- Select the cash receipt account in the drop-down menu for accounts

- From the Customer list, choose the appropriate tenant

- Enter the rent payment amount. Click “Ok” to preserve the receipt if you are only entering the rent for one tenant

- Select “Group with other undeposited funds” to proceed to the next cash receipt entry if you have rent from more than one tenant.

The Limitations of Using QuickBooks for Rental Properties

Although QuickBooks is the most popular accounting programmed for small businesses, there are significant restrictions when using it for real estate, particularly when managing rentals. In contrast, rental property management is made simpler by industry-specific capabilities found in property management software.

- The first drawback of utilizing QuickBooks for a rental property is how challenging it is to set things up properly. Adopting new software typically involves a learning curve, but this can be especially challenging when the product isn’t specifically made for your needs. You need to have a deeper understanding of QuickBooks because it wasn’t created with landlords in mind before it can start saving you time.

- The absence of industry-specific functionality in QuickBooks is the second significant drawback. For instance, even though it makes invoice payments easier, it lacks a tenant site where your tenants might check past and upcoming payments or set up automated online rent payments in QuickBooks. It also lacks the ability to automate rent reminders or send tenants pre-written emails. Additionally, QuickBooks lacks features like built-in tenant screening.

- These factors contribute to the increase of landlords using property management program. Using such software, you can organize your finances by asset or unit. Additionally, its default settings include typical income and expense categories. The ability to distinguish between rent and other types of revenue, make reminders, and save all of your pertinent paperwork and receipts in one location are other capabilities.

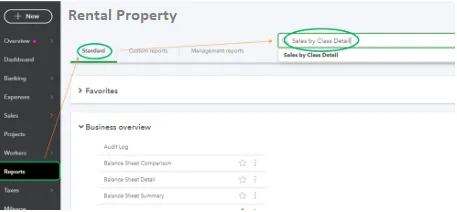

How to Create a QuickBooks Rental Properties?

- You will need to add a New Customer to your dashboard. Additionally, this will be referred to as a new building

- At the top of the QuickBooks navigation panel, click on the customer tab and then select the customer center to create a new customer

- You will now be on a customer information window; click the new customer tab to start creating new clients for yourself

- QuickBooks will now request a name from you. Put your building’s street address in the name, such as “1203 Boulevard road”

- Next, make a Unit. Because the option is not available, you cannot construct a unit in that manner. Making a Job would therefore be the challenge.

You can do this by doing the following:

- To find New Customer, hover your cursor over the top left corner of the current window

- Select Add New Job from the drop-down option

- Use the number of units you have on your property at 1203 Boulevard Road as the job’s name. For example, if your home has

- The unit number 501, name your employment after it

- If you have more units, keep adding jobs to your building to accommodate them

- Create tenants. You can accomplish that by turning the existing task into a sub job.

You can achieve this by using the subsequent procedure:

- Choose the Unit that you wish to assign your tenant to by clicking on it

- For example, if the unit number is Unit 501, click on it and then go to the section where you can add a new task

- As soon as a new window appears, give your tenant a name. This might resemble John Matthew.

Once everything is finished, you’ll have a structure that looks like this:

- 1203 Boulevard Road

- Unit 501

- John Mathew

- You’ll want to display your rental money within the application

- To do this, select the Customers tab from the top navigation bar

- From the drop-down list, choose Create an Invoice

- Affix the name “Rental income”

- Choose the renter from whom you want to receive a rental revenue. It would be John Mathew in our situation

- Choose the amount that you have been paid in rental revenue

- Using the drop-down menu, connect the account to the Rental Income account

- You’ve now created your first rental property in QuickBooks by selecting “Ok” >>> “Save” and then select the “Close” button.

Conclusion!!!

Hopefully, this article gave you all the essential knowledge you needed to use QuickBooks for rental properties. You may quickly get in touch with the team of specialists to learn more about accounting software and the best ways to fix QuickBooks errors report or any other functional issues. The team will be committed to answering all of your questions all round the clock. If you have any specific query, also get in touch with the experts of Live Chat 24×7 Help.

A Frequently Asked Questions

What are the Steps Involved in Recording Rent Payment in QuickBooks?

The below steps help you to record rent payment in QuickBooks:

- Firstly Launch the QuickBooks programmer, then choose Customer: Job List from the list menu

- Choose the customer, then choose Enter Statement Charges from the actions menu

- Then select the empty field at the register’s end

- The amount of rent that must be paid is then entered in the field for rent

- After that, choose “Accounts Receivable” from the Account drop-down menu

- Finally, select Record to complete the entry.

How Do I Generate an Invoice for your Rental Property in QuickBooks?

You can perform the below measures to take into actions in order to create an invoice for rental property:

- Firstly Create a client ID for the rental property

- Find the Customer Center and open it

- Select the Customer Center

- After that, hit on the New Client/Job

- Fill up the necessary information followed by selecting on the “Ok” button

- You rent in the same property and set a job for a certain section

- Select the New Job button that appears in the New Customer menu

- Enter the tenant’s name and contact details Click “Ok” to save the changes Find the Customer option

- Choose Create Invoices, click New Invoice Template, or choose an existing template, then choose the tenant you wish to bill from the Job drop-down menu

- You can also add more lines for adding additional items after you have written the rent amount and a description

- Select either To be printed or To be mailed as the invoice’s delivery option

- At last, click “Save” and “Close”.

Does QuickBooks Work Well for Managing Rental Property?

Yes, QuickBooks serves as a fantastic accounting solution for your rental transactions. To operate a rental business, you can configure properties as customers, Set up Multiple Rental Properties classes to track different transaction kinds, and tenants as sub-customers. The tenant sub-customer will show all rent invoices, associated payments, the current balance, etc.